Learn the risk factors and the gains well before investing in premium financed life insurance.

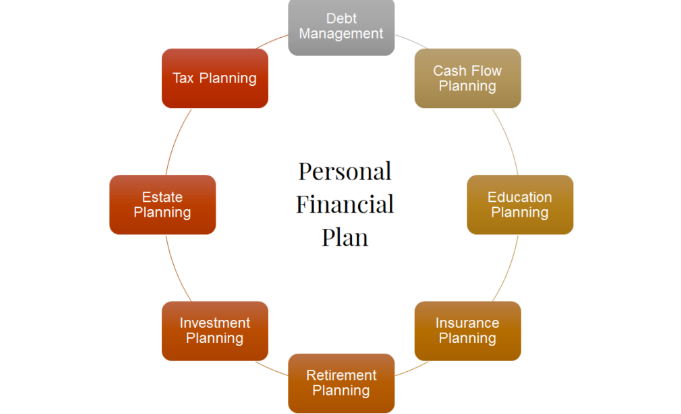

Firstly, you must be aware that Premium Financed Life Insurance doesn’t cater to everybody’s needs and this is well-known to a life insurance agent. Premium finance life insurance is viewed as the harmless way to purchase life insurance, particularly for higher net worth people. Premium financing really works well when it is planned and checked suitably and Personal Financial Planning to has been done well. Nonetheless, there are some dangers that one should be aware of.

Risk factors for premium financed life insurance

Before engaging in such policies, know the 10 major risk factors as described below:

- Interest rates which are now low can rise tremendously in the near future. Generally, these rates remain static for the one-year period before they are adjusted in the coming year. This way, an unforeseen hike can alter the outlook and the financed policy.

- Taxation can turn tricky for one premium-financed policy as the degree to which there is a possibility of taxation, are hugely dependent on the accomplishment of the policy. So, before starting the policy you must keep in mind all the vital tax implications to make sure that the finishing price of the policy at maturity surpasses the loan amount.

- These insurance policies are remarkably different from the ordinary cash value policies and here the owner doesn’t have the right to withdraw or borrow bucks from the policy as there is a Contract Act.

- The policy lacks the death benefits as increased death benefit also means a higher premium. In this condition, the policyholder has to surrender himself to the higher premium in order to enjoy increased death benefits.

- The majority of the advisors use (IULs) index universal life policies. Because there are many probable returns, the policy sometimes fails to keep pace with the charged interest rates.

- In this policy, the lender generally needs a security which can either be liquid or cash investment portfolio. In case, the security pledged turns into an investment account, it does increase the amount which had the possibility of getting lost by none other than the policyholder.

- A slip-in performance can need additional loans or premium. This way, it upsurges the dangers of financial ruin if the policy lapses.

- This is a huge risk as there is no confirmed news that the lender is going to renew the loan process when it is needed. Actually, loans for one premium-financed life insurance are usually given for 3 to 5 years. If and when the policy needs extra loans to prevent it from getting lapsed, the lender is not obliged to renew the loan. Here, the borrower has to do the renewal process. Again, unfortunately, if the client’s income drops then the lender has full liberty to decline the extension of the loan.

- If the loan lives for a longer period of time, the costlier the loan will turn out to be and a lender is given the right to upsurge the rate of the loans.

- In this type of policy, both the advisor and the insurer responsible remain in a dangerous position of litigation risk if and when the transaction becomes downhill.

Although this type of policy is really helpful for many people it’s not appropriate for every individual. So, it is of utmost importance to go through the risk factors carefully before plunging into it.